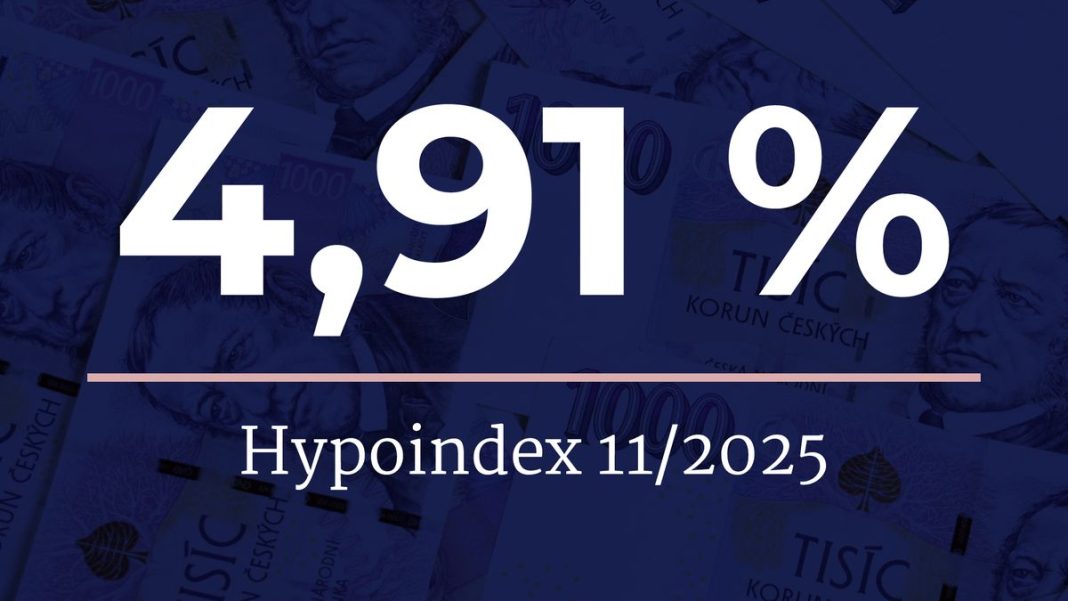

The current state of the mortgage market is marked by a freeze on interest rates, shifting focus to refinancing opportunities while cosmetic discounts offer little relief to prospective homebuyers. With potential buyers facing market challenges, it’s crucial to understand the dynamics at play.

The Impact of Frozen Rates on the Housing Market

In recent months, the mortgage market has seen interest rates remain stagnant. This freeze on rates has caused a significant shift in housing market dynamics, pushing both borrowers and lenders to adapt. As a result, financial strategies are being reevaluated, with some turning to refinancing as a way to manage costs.

Frozen rates often lead buyers to reconsider their timing for entering or exiting the market. Some may wait, hoping for future reductions, while others might seize current rates to lock in predictable payments. However, the lack of movement in rates can stifle market activity, slowing transactions and affecting overall housing supply.

Refinancing: A Key Driver Amidst Stagnation

With interest rates stable, refinancing has emerged as a vital tool for both bankers and homeowners. Lowering existing loan payments or consolidating debts can offer significant financial relief, especially as inflation impacts living costs. Homeowners may seek new terms that offer better financial resilience under current economic conditions.

Banks, on the other hand, have taken advantage of refinancing as a lucrative business opportunity. By focusing on existing customers, they can foster long-term relationships while capitalizing on smaller, yet steady, profit margins from refinancing arrangements.

Discounts: More Cosmetic than Substantial

Despite the challenging environment, many banks and real estate agencies offer discounts and promotions to entice buyers. However, these discounts often prove to be more cosmetic than substantial. Token reductions in fees or slightly lowered initial rates are designed to attract attention rather than provide genuine financial relief.

Such marketing strategies can temporarily boost customer interest but often fall short of significantly altering the financial commitments of buying a home. Buyers are advised to examine these offers carefully and consider the long-term implications of their mortgage agreements.

Strategic Considerations for Homebuyers

For prospective buyers, understanding these market trends is essential. Buyers should evaluate their financial readiness and consider whether now is the right time to purchase or refinance a home. Consulting with financial advisors or mortgage experts can provide insights tailored to individual circumstances.

In addition to economic factors, potential buyers in Prague or broader Czechia should consider local real estate market conditions. Regional factors such as urban development plans or demographic shifts can influence real estate values independently of national mortgage trends.

In conclusion, while the mortgage market currently presents challenges with frozen rates and superficial discounts, it also offers opportunities through strategic refinancing. For those navigating these waters, careful consideration and expert advice can guide successful financial decisions.