Mortgage rates in Prague have recently surged, and experts are cautioning homeowners that further increases may be on the horizon. This uptick poses significant challenges for both new home buyers and current mortgage holders.

Current Trends in Mortgage Rates

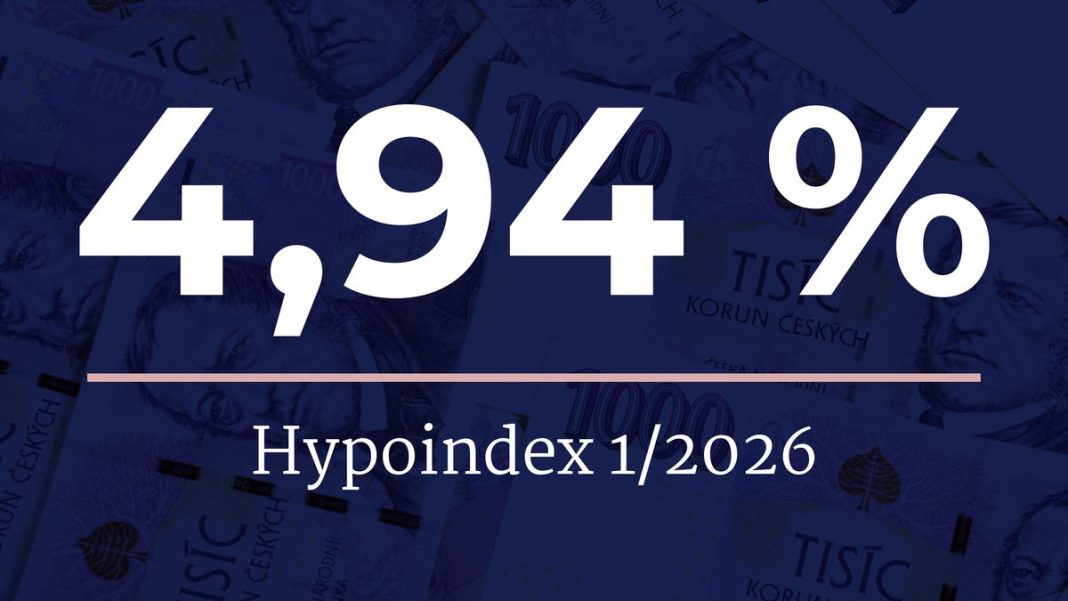

The mortgage market in Prague has experienced a noticeable rate hike over the last quarter. This shift is largely attributed to global economic pressures and changes in central bank policies. As interest rates rise, so does the cost of borrowing, affecting the affordability of homes for many potential buyers.

Economists suggest that these increases are a reaction to inflationary concerns, which governments and financial institutions are striving to control. In turn, lenders have been adjusting their rates to balance the demand for home loans with the need to maintain economic stability.

Impact on Home Buyers and Owners

For new home buyers in Prague, the rising mortgage rates mean higher monthly payments, making it more challenging to afford their desired properties. This could lead to a slower housing market as buyers may be more hesitant or unable to commit to purchasing homes at these higher financing costs.

Existing mortgage holders with variable-rate loans are also feeling the strain. As their monthly payments increase, some might face financial difficulties, potentially leading to a rise in loan defaults if wages do not keep pace with these new demands.

Potential Future Rate Hikes

Analysts are predicting that this trend of rising rates may continue throughout the year. Factors such as ongoing global economic instability and domestic financial policies are contributing to the uncertainty. These predictions underscore the importance of strategic financial planning for those seeking new homes or refinancing current loans.

Prospective buyers and current homeowners should seek advice from financial advisors to navigate these turbulent times. Locking in rates sooner rather than later could be a beneficial strategy for many, providing some insulation against further increases.

Government and Institutional Responses

The Czech National Bank plays a pivotal role in setting the country’s interest rates, and its decisions will significantly influence future mortgage costs. The bank’s actions are guided by economic indicators that can help allay inflation without stifling growth.

There is also a growing expectation that the government might introduce measures to help alleviate the burden on home buyers. These could include subsidies or incentives for first-time buyers or efforts to stabilize the housing market through policy adjustments.

While the current outlook for mortgage rates is challenging, careful financial planning and staying informed can help weather the storm of potential future hikes.