The Czech Republic’s Finance Minister, Alena Schillerová, has been pushing for a universal electronic evidence of sales (EET) system. However, her vision is met with the need for coalition compromise, as divergent perspectives among coalition partners initiate discussions on the system’s future.

The Vision for Universal EET

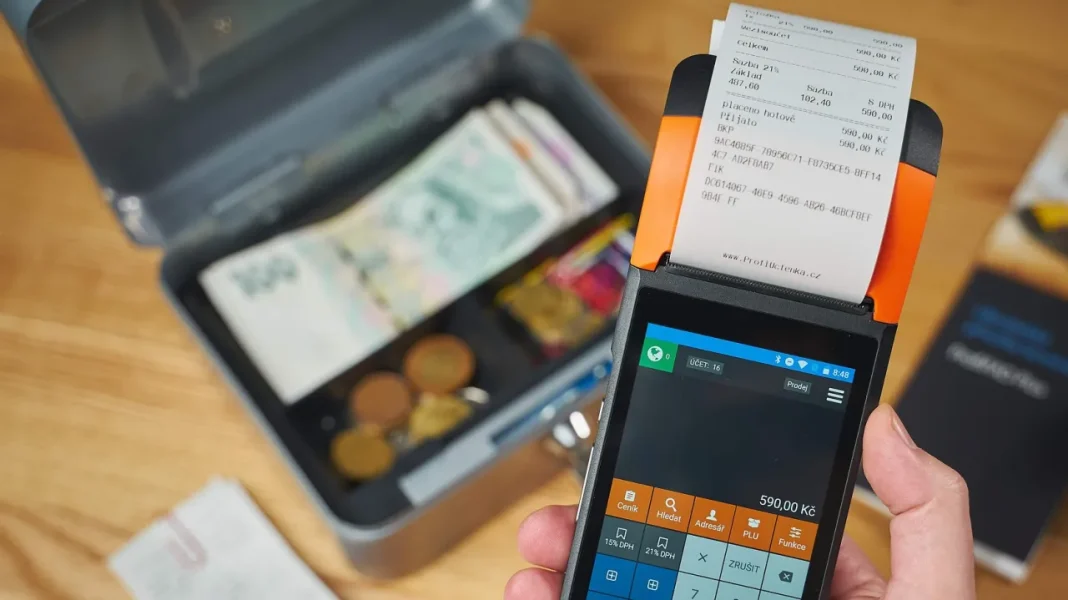

Schillerová advocates for the universal implementation of the electronic evidence of sales system to improve transparency and reduce tax evasion across all sectors. Her plan includes extending the EET to small traders and other services not previously covered. She argues that a universal system would create a fair business environment and enhance governmental fiscal health by reducing black market activities.

Despite the clear benefits outlined by Schillerová, not all coalition partners are convinced. Some fear that extending the EET could burden small businesses with additional costs and administrative requirements. As such, debates are ongoing to determine how to best implement a system that meets all parties’ needs.

Challenges and Opposition

Opposition to the universal EET stems mainly from small business advocates and political parties concerned about bureaucratic weight. These groups argue that the system increases operational costs for small entrepreneurs who lack the resources to accommodate new technology and processes. They advocate for exemptions or simplified procedures for smaller operations.

Additionally, there are concerns about the privacy and security of financial data that would be collected and processed under the expanded EET system. Ensuring robust data protection measures is crucial to gaining broader acceptance and mitigating these anxieties.

Negotiations Within the Coalition

The coalition government is comprised of parties with varying economic philosophies, necessitating compromise and negotiation. Schillerová is engaging in talks with coalition partners to craft a balanced approach that could see gradual implementation, initially targeting sectors with higher revenue, while considering exemptions for the smallest businesses.

These negotiations focus on finding common ground that acknowledges economic realities while striving to uphold tax fairness and system integrity. The outcome of these discussions will likely shape the trajectory of the EET system’s expansion.

Possible Outcomes and Future Prospects

The potential success of Schillerová’s proposal hinges on carefully crafting a legislation that addresses partner concerns. Possible outcomes include phased implementation or tiered systems based on business size or sector. This compromise could ensure universal adherence while providing flexibility to smaller enterprises.

Future prospects for the EET will depend on its capacity to both support the government’s financial goals and accommodate the practical needs of diverse business operators, ensuring that the transition to a wider electronic sales evidence system is smooth and minimally disruptive.

In conclusion, as discussions continue, the universal EET initiative presents an opportunity for reforming fiscal policy in the Czech Republic. Whether it will materialize in its intended form will depend largely on the coalition’s ability to reconcile differences and establish an equitable framework for all stakeholders.